Financial Literacy of Students | 5 Financial Philosophers

Who doesn’t want to feel free? How many of us are independent of financial dilemmas? Whether you’re a college student or a well-paid general contractor, you are always concerned regarding your income.

The subject of the financial literacy of students is one of the least focused on areas. Youth is the perfect time to gain a full insight into personal finance, basic investment philosophy, day-to-day money management and other related ideas. Even students from commerce backgrounds know little about financial literacy. The good news is that many people on the internet give free resources to improve students' financial wisdom. It’s perplexing to choose the ideal person to follow to gain the knowledge one lacks. We have listed five people who have already gained their freedom and they share everything they learned about financial liberty.

Financial Literacy of students: Whom Should You Follow?

Below, we listed their names and speak of their expertise in financial literacy. Read the full article. I'm sure you'll be intrigued.

Naval Ravikant:

Chances are high that Naval Ravikant is a new name to you. As to where Naval Ravikant is from, he was born in New Delhi, India, and graduated from Dartmouth. He is one of those persons who knows the most in the class but never gets called upon. Let’s start with one of Naval Ravikant’s tips and tricks regarding wealth creation which is:

The formula of wealth creation:

What you want to do is fundamentally put yourself in a situation where you take your specific knowledge that you've developed over the years without even trying the things you're good at that other people are naturally bad at.

You add that to accountability, put your name on it, take some risks, and you employ every form of leverage possible, capital, labor, products, and code, preferably the permission-less ones, because those you can get access to when you're younger.

The net result is that you productize yourself; what you end up doing is selling a product that is simply an extension of who you uniquely are, and nobody can beat you at that.

"It's just you, being you."

‘Being you’ will take a while to set up, but once you set this thing up, it will bring a flood, a tsunami of money that will keep you flush for the rest of your life.

Naval Ravikant is famous because he teaches people how to make money through his popular AngelList. According to the official description, it allows you to find thousands of startup jobs near you, invest in the latest startups, and discover new products that are just about to launch.

Naval, an investor, co-founder, and CEO of ventures, has invested in over 100 companies. He was an early stage investor in Uber, Clubhouse, Twitter, and many other renowned startups.

Mr. Money Mustache:

Mr. Money Mustache is a retired engineer who now writes about how we can all live a frugal yet badass life of leisure. This Canadian computer engineer left his job back in 2005 to look after his family. He began to support his family only with income from house rents and also living a lifestyle about 50% less expensive than most of his peers. He invested the surplus in index funds.

If Cardone gives you fearless financial literacy, then Mr. Money Mustache is at the opposite extreme. He will show you every possible path to a frugal lifestyle.

The reason behind listing two people with opposing views is that not everybody will be comfortable with practicing the expensive viewpoint of Cardone. So, those who find it more suitable to stick to the less-spending lifestyle, simply follow Mr. Money Mustache. While browsing his blog, you will find a solution to avoid health insurance. Sometimes you will find a pathway to invest your money in the stock market without worrying too much about money.

Suppose you get bored with regular financial gurus. In that case, Mr. Money Mustache picks a real-life money management issue, cracks it and then explains it in the most sophisticated way. Many of his colleagues and friends were broke and complained about the middle-class lifestyle struggles during the pre-financial crisis period. They were also commenting on daily life issues and the future of their children. There were perpetual complaints about the lack of free time and the scarcity of money. While everyone seemed serious about their careers, their funds and the sharing of their struggles, nobody was earnest about finding a solution to get themselves out of said lifestyle. Instead, they were busy sharing their latest car purchase, household chores, apartments, and expensive items. And, at the end of the day, each of them went home carrying the heavy burden of debt. Mr. Money Mustache's friends are represented all over the country. They all have similar lifestyles and each has, more or less, the same financial difficulties. These people were living costly lifestyles yet thinking they were completely normal. Then, at the end of the day, they were baffled when they had no money left over, to buy their freedom.

To understand the problem, Mr money Mustache delved deep into the issue and found the root of the problem. So, he decided to create a blog and share all of his secrets with people so they too could live a financially sound life.

You will get all of the necessary information to lead a better life than your existing one and, surprisingly, it will require 50-70% less money.

Grant Cardone:

With 25+ years of sales training experience, Grant Cardone is mostly occupied with people of small- and medium-sized businesses and with Fortune 500 companies, worldwide. Grant Cardone primarily works with them to increase their annual sales revenues.

Tell me one instance when you were worried yet took the smartest decision of your life. When we are in a rush, we tend to make mistakes. Exactly, Cardon emphasis on this particular point while sharing his experience with people.

When people spend a lot of money, they tend to get worried about their spending. He advises people not to worry about this habit. Rather, concern yourself with how you can spend a lot of money and still manage your money efficiently, to cover your spending. Once he emphasized, ‘‘Your problem is never debt or spending.’’ When you focus your time and energy on creating wealth instead of worrying about your current 'scarce-money' state or day-to-day life struggles, you will be happier. You will become a better manager of your money to lead a financially and mentally stable life.

Motivation gurus will always quote the phrase, "the sky is the limit." You have endless potential. It becomes a cliche, but this line is still relevant to any context of your life.

As human beings, we have endless potential to earn money. At the same time, we can substantially reduce our everyday living expenses by choosing a frugal life.

It’s completely okay how you choose to lead your life. You can choose to raise your earning bar, or you can start practicing a frugal lifestyle. Cardon’s point is that it’s better to meet your needs and wants by utilizing your actual earning potential rather than focusing on a frugal lifestyle.

Middle-class people are the worst victims of any kind of economic uncertainty. He specifically urges middle-class people to choose a fearless life path in order to change their lives to high-income earners. Cardone expressly focuses on turning middle-class sentiment into a higher incomer mindset. His real-life tips and tricks are worth following, if you want to get out of the middle-class trap. He is a real estate mogul with about 350 million apartment complexes throughout the United States. He accumulated this wealth utilizing his personal money and traditional bank financing.

An extra income stream is not necessary but it always can be useful. Everyone will be happy living with a moderate surplus income. Cardone most often shares tips and tricks with his 1.3+ million social media followers to use all of the potential extra income generating sources by investing in residential real estate.

Without a doubt, Cardone is the ideal person to follow for financial literacy.

Warren Buffett:

There is no need to give a formal introduction for Warren Buffett. We all know about his legacy and the greatness of his financial philosophy. But how many of us courageously and intently follow his words? Most of the time, we share his quotes on social media and do the exact opposite thing after that. His words are very intriguing and straightforward but may be challenging to follow.

Warren Buffett shares everything he knows about creating wealth and feels comfortable calling himself a value investor. It means he informs himself about undervalued companies and also companies with potential, who will increase in value in the long run, and then invests in those companies.

From Banjamin Graham, he got his inspiration for the value investing approach. Value investors are always looking for undervalued securities. Then they try to figure out the right time to invest in these securities. Determining whether a company is undervalued or overvalued depends on the intrinsic worth it possesses to the analysts. There are no hard and fast rules to determine a stock’s true worth, but people often estimate the value by analyzing a company's fundamentals.

Buffett, however, hardly bothers with the supply and demand intricacies of the stock market. He is indifferent about the regular activities of the stock market and he barely gets influenced by market hype. His stock market practices reflect one of Benjamin Graham's lines: "In the short run, a market is a voting machine, but it is a weighing machine in the long run."

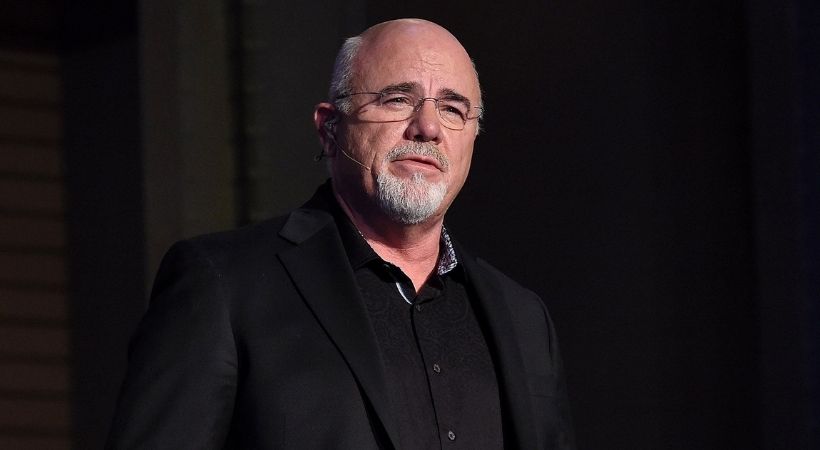

Dave Ramsey:

Dave Ramsey is an American multimillionaire businessman and radio host. He is renowned for his debt eliminating practices.

Ramsey experienced the bitter experience of bankruptcy early in his career at the age of 26. Shortly before, he had been a millionaire, and then all of a sudden, he filed for bankruptcy. But, showing unwaving determination, Ramsey soon learned to create wealth from scratch. He has never borrowed money since this early experience and proudly speaks about his zero debt financial career.

He runs one of the largest radio programs in the United States. Through his 'The Dave Ramsey Show,’ he teaches more than 13 million regular listeners tips and tricks to get out of debt quickly. Ramsey responds to callers’ queries in his regular episodes and answers all of their concerns by relating a wide range of real-life, money-related examples. His show covers areas like 'how you can invest appropriately' and 'the most appropriate way to pay off multiple credit card balances'.

Ramsey is also the author of multiple New York Times' bestselling, personal finance books. Take a gander at his top-selling books like, 'The Total Money Makeover' and 'Dave Ramsey's Complete Guide to Money.'

Conclusion:

No matter how many financial philosophers, gurus and personalities you know, if you don’t heed their words, you're not going to get anywhere (financially). Everyone mentioned above has had success utilizing their financial widom and a little instinct, to achieve a financially independent life.

Financial freedom is one of the top types of liberty I can think of. Financial freedom doesn’t necessarily mean you have to become a millionaire or a billionaire. It means to be in a position where you only have to work if you feel like it. So, a person earning below 20k may achieve financial independence through living the frugal lifestyle taught by Mr. Money Mustache. On the other hand, another person may get financial freedom, even when spending 2 million yearly, by following Cardon’s philosophy.

Delve deep into the philosophy of the persons mentioned above, what they try to teach and how they got their freedom in life. Just imitate their techniques until you find your own path to gaining financial literacy and freedom

Similar Posts

How do you email a professor about funding?

How to Email a Professor About Research Opportunities

Avoid Getting Into A Fake University/College In Canada

How To Get Cheap Flights For Students

How to accomplish what you want - S.M.A.R.T. Goals for Students

Fake Friend? Learn the types of the fake friends

A Complete Guide on How to Write a Statement of Purpose

Graduate Admission Committee- What do they look for in an applicant?

Writing a Scholarship Essay That Indeed Works!

Have a wonderful topic in mind?

Email us at contact@skipissues.com